How

to Start a Business

How

to Start a Business

A Step-By-Step Guide to Starting a Small

Business

By Meir Liraz

Copyright © by Meir Liraz. All rights reserved.

Free Small Business Templates and Tools

Here's a collection of business tools featuring dozens of templates, books, worksheets, tools, software, checklists, videos, manuals, spreadsheets, and much more. All free to download, no strings attached.

► Free Small Business Templates, Books, Tools, Worksheets and More

Table of Contents

1. What you need to know before you

start

2. Determining the feasibility of your business idea

3. Starting your new venture

4. Buying a going business

5. Choosing a franchise

6. Ten essential aspects of managing a business

7. Special requirements and needs

8. Time to make the decision

9. Going into business FAQ

10. Checklist for starting a business

1. What You Need to Know Before you start

So you are thinking of going into business. This can have advantages and disadvantages. Running a business of your own will bring a sense of independence, and a sense of accomplishment. You will be the boss, and you can't be fired, though there may be days when you would welcome it. Because you can pay yourself a salary and the profit or return on your investment will also be yours, you anticipate a good income once your business is established. You will experience a pride in ownership - such as you experience if you own your own home or your own automobile. You can derive great satisfaction from offering a product or service which is valued in the market place.

By being boss you can adopt new ideas quickly. Since your enterprise undoubtedly will be a small business - at least in the beginning - you will have no large, unwieldy organization to retrain, no board to get permission from, each time you wish to try something new. If the idea doesn't work you can drop it just as quickly. This opportunity for flexibility is one of small businesses greatest assets.

These are some of the advantages and pleasures of operating your own business. Now take a look at the other side. If you have employees, you must meet a payroll week after week. You must always have money to pay creditors - the man who sells you goods or materials, the dealer who furnishes fixtures and equipment, the landlord if you rent, the mortgage holder if you are buying your place of business, the publisher running your advertisements, the tax collector, and many others. All of these must be paid before you can consider the "profits" yours.

You must accept sole responsibility for all final decisions. A wrong judgment on your part can result in losses not only to yourself but, possibly, to your employees, creditors, and customers as well. Moreover, you must withstand, alone, adverse situations caused by circumstances frequently beyond your control, To overcome these business setbacks and keep your business profitable means long hours of hard work. It could very well not be the work you want to do. As someone else's employee you developed a skill. Now, starting a business of your own, you may expect to use that skill 40 or more hours a week. Instead, you must perform the management tasks as well. You must keep the books, analyze accounting records, sit back and do long range planning, jump and handle the expediting and, when everyone has gone home and you finally have caught up with the paper work, you may even have to sweep the floor.

As your business grows and you become more successful, you may not do some of these activities. As an owner-manager, however, you must - at least at first - give up the technical aspects you know and enjoy doing, and focus on the management aspects. To get your business off to a successful start, you must be a manager not an operator.

You will never be entirely your own boss.

No matter what you choose - manufacturing, wholesaling, retailing or service business - you must always satisfy your customers. If you don't give the customers what they want, they'll go somewhere else and you'll be out of business. So every customer, or even potential customer, is your boss. Your creditors will also dictate to you, and your competitors' actions may force you to make decisions you don't want to make. National and local government agencies will insist that you meet certain standards and follow certain regulations. The one thing you can decide yourself is how you will satisfy all of these bosses.

Are You the Type?

The first question you should answer after recognizing that there are two sides to the prospect of establishing your own business is "Am I the type?"

You will be your most important employee. It is more important that you rate yourself objectively than how you rate any prospective employee. Appraise your strengths and your weaknesses. As a prospective operator of your own business, acknowledge that you are weak in certain areas and cover the deficiency by either retraining yourself or hiring someone with the necessary skill.

Numerous studies have been made of small business managers over the years. Many look at traits and characteristics that appear common to most people who start their own businesses. Other studies focus on characteristics that seem to appear frequently in successful owner-managers.

First, consider those characteristics that seem to distinguish the person who opens a business from the person who works for someone else. These studies investigated successful and unsuccessful owners, some of whom went bankrupt several times. Some were successful only after the second or third try. The characteristics they share might almost be said to predispose a person into trying to start a business. Of course, not all of these characteristics appear in every small business owner-manager, but the following seem to be most predominate.

Take the Entrepreneur Test to assess your Entrepreneurship Skills.

Strong Opinions and Attitudes

People who start their own business may be members of different political parties, feel differently about religion, economics and other issues. They are like everyone else. The difference is they usually feel and express themselves more strongly. This is consistent. If you are going to risk your money and time in your own business you must have a strong feeling that you will be successful. As you will see later, these strong feelings may also cause problems.

If you want to start your own business you probably have mixed feelings about authority. You know the manager must have authority to get things done, but you're not comfortable working under someone. This may also have been your attitude in a scholastic, family or other authority structure.

Are You the Type?

If you want to open you own business you are likely to have a strong "Need for Achievement". This "Need for Achievement" is a psychologist's term for motivation and is usually measured by tests. It can be an important factor in success.

The person who wouldn't think of starting a business, might call you a plunger, a gambler, a high risk taker. Yet you probably don't feel that about yourself. Studies have shown that very often the small business owner doesn't differ from anyone else in risk avoidance or aversion when measured on tests. At first thought this seems unreasonable since logic tells us that it is risky to open your own business. An Ohio State professor once explained this apparent contradiction very simply. "When a person starts and manages his own business he doesn't see risks; he sees only factors that he can control to his advantage."

If you possess these traits to some degree or other it doesn't mean you will be successful, only that you will very likely start your own business. Some of these characteristics in excess may actually hamper you if you are not careful.

The characteristics that appear most frequently among "successful" small business managers include drive, thinking ability, competence in human relations, communications skills and technical knowledge.

Drive, as defined in the study, is composed of responsibility, vigor, initiative, persistence and health. Thinking ability consists of original, creative, critical, and analytical thinking. Competency in human relations means emotional stability, sociability, good personal relations, consideration, cheerfulness, cooperation. and tactfulness. Important communications skills include verbal comprehension, and oral and written communications. Technical knowledge is the manager's comprehension of the physical process of producing goods or services, and the ability to use the information purposefully.

Motivation or drive has long been considered as having an important effect on performance. Psychologists now claim you can increase the motivation and the personal capacities that will improve your effectiveness and increase your chances for success. Much of the development of such achievement motivation depends on setting the right kind of goals for yourself.

What Business Should You Choose?

Many of you have already decided what business to choose. Others may still be seeking answers from counselors. Whether you have decided or not, you will find it helpful to continue your self-evaluation.

Begin by summarizing your background and experience. Include jobs. schooling, and hobbies. Then write down what you think you would like to do. Does what you would like to do match up with what you have done? It is helpful if your experience and training can be put to direct use in your new enterprise.

What are your prospective needs? What are your prospective customers' needs? You may make money doing something you don't like if people will pay for it. On the other hand, you will never make money if people don t need your product or service no matter how happy you are doing it. Experts have said more companies fail because they are in the wrong business than because they are "doing business wrong".

Read, listen to the experts, talk to business people, try to determine where growth will occur. Most new businesses can only get customers by taking them away from someone else, or by attracting new people entering the area. In other words, don't start a contracting business in a community where the population is decreasing even if you are a good contractor.

At this point, try to match your background and interests with what you see the needs to be. If they match, wonderful. Now all you have to do is discover how to offer the customers more for their money than do your competitors.

If the needs and your background don't match, don't despair. Get training by working in a company that provides a product or service that is needed. Find a job in a well managed, successful company of the kind you are contemplating. Then absorb as much management know-how as you can while learning the technical skills.

Are You the Type?

Education can help too. While there may be no educational requirements for starting your own business, the more schooling you have along the right lines the better equipped you should be.

(Some fields require licenses, certificates, even degrees in specific educational areas.) Certainly it is helpful if you have had courses in record keeping, sales and communication. These needn't be college or even high school courses. They can come from adult education programs and the like.

Is there a need for what you want to sell or do? Are you prepared to fill that need? Are you interested in the area? Can you learn what you need to? Will there be a continuing and growing need for your product or service?

Your Chances of Success

What are your chances of success if you go into business? New businesses are always being started. Almost as many are failing or being discontinued. A year of poor business conditions is likely to be followed by a greater than average number of failures or closings. A year of good business conditions tends to be followed by large increases in the total number of businesses. In general, the number of firms increases with increases in human population, total personal income and per capita income and since these factors have increased regularly, the total number of small businesses usually rises every year.

This growth is not free of growing pains, however. At the same time new businesses are being born other businesses are being discontinued. Some of these discontinuances are legally business failures; other owners give up to avoid or minimize losses and are not failures in the strict sense. Still others discontinue for reasons such as the death or retirement of the proprietor, the dissolution of a partnership, or the sale of the business to a new owner.

Younger businesses tend to discontinue first. Many do not make it through the first year. The discontinuation rate of those that survive this first year "burn-in" declines steadily until at the end of several years the rate has dropped dramatically. So, your chances of success improve the longer you stay in business.

Poor management is the largest single cause of business failure. Year after year, the lack of managerial experience and aptitude has accounted for around 90 percent of all failures analyzed by Dun & Bradstreet, Inc.

Many factors may adversely affect individual firms over which owners have little control. In such cases, the astute manager can often soften the blow or, sometimes, change adversity into an asset. Examples of factors over which the owner has little control are overall poor business conditions, relocations of highways, sudden style changes, the replacement of existing products by new ones, and local labor situations. While these factors may cause some businesses to close, they may represent opportunities for others. A local market place may decline in importance at the same time new shopping centers are developing. Sudden changes in style or the replacement of existing products may bring trouble to certain businesses but open doors for new ones. Adverse employment situations in some areas may be offset by favorable situations in others. Ingenuity in taking advantage of changing consumer desires and technological improvements will always be rewarded.

In the final analysis, it is up to you. Will your management be competent? Will you be able to judge, and then satisfy, your customers' wants? Can you do this accurately and quickly enough to more than compensate for risks due to factors beyond your control? Such accomplishment requires expert management.

Will the rate of return on the money you invest in your business be greater than the rate you could receive if you invested your money elsewhere? While your decision to go into business for yourself may not depend entirely upon this, it is a factor which should interest you. Too frequently people invest money in their own businesses under the misapprehension that the financial return will be far greater than the return from other investments. Investigation of the average annual returns in the line of business in which you are interested may be worthy of your time.

Your decision to go into business may not depend entirely on financial rewards. The size of the potential return on your investment may be overshadowed by your desire for independence, the chance to do the type of work you would like to do, the opportunity to live in the part of the country or city you prefer, or the feeling that you can be more useful to the community than you would be if you continued working for someone else. Do not overlook such intangible considerations. But remember, you cannot keep your own business open unless you receive an adequate financial return on your investment.

2. Determining the Feasibility of Your Business Idea

This chapter is a checklist for the owner/manager of a business enterprise or for one contemplating going into business for the first time. The questions concentrate on areas you must consider seriously to determine if your idea represents a real business opportunity and if you can really know what you are getting into. You can use it to evaluate a completely new venture proposal or an apparent opportunity in your existing business.

Perhaps the most crucial problem you will face after expressing an interest in starting a new business or capitalizing on an apparent opportunity in your existing business will be determining the feasibility of your idea. Getting into the right business at the right time is simple advice, but advice that is extremely difficult to implement. The high failure rate of new businesses and products indicates that very few ideas result in successful business ventures, even when introduced by well established firm. Too many entrepreneurs strike out on a business venture so convinced of its merits that they fail to thoroughly evaluate its potential.

This checklist should be useful to you in evaluating a business idea. It is designed to help you screen out ideas that are likely to fail before you invest extensive time, money, and effort in them.

Preliminary Analysis

A feasibility study involves gathering, analyzing and evaluating information with the purpose of answering the question: "Should I go into this business?" Answering this question involves first a preliminary assessment of both personal and project considerations.

General Personal Considerations

The first seven questions ask you to do a little introspection. Are your personality characteristics such that you can both adapt to and enjoy business ownership/management?

1. Do you like to make your own decisions?

2. Do you enjoy competition?

3. Do you have will power and self-discipline?

4. Do you plan ahead?

5. Do you get things done on time?

6. Can you take advise from others?

7. Are you adaptable to changing conditions?

The next series of questions stress the physical, emotional, and financial strains of a new business.

8. Do you understand that owning your own business may entail working 12 to 16 hours a day, probably six days a week, and maybe on holidays?

9. Do you have the physical stamina to handle a business?

10. Do you have the emotional strength to withstand the strain?

11. Are you prepared to lower your standard of living for several months or years?

12. Are you prepared to loose your savings?

Specific Personal Considerations

1. Do you know which skills and areas of expertise are critical to the success of your project?

2. Do you have these skills?

3. Does your idea effectively utilize your own skills and abilities?

4. Can you find personnel that have the expertise you lack?

5. Do you know why you are considering this project?

6. Will your project effectively meet your career aspirations

The next three questions emphasize the point that very few people can claim expertise in all phases of a feasibility study. You should realize your personal limitations and seek appropriate assistance where necessary (i.e. marketing, legal, financial).

7. Do you have the ability to perform the feasibility study?

8. Do you have the time to perform the feasibility study?

9. Do you have the money to pay for the feasibility study done?

General Project Description

1. Briefly describe the business you want to enter.

________

2. List the products and/or services you want to sell

________

3. Describe who will use your products/services

________

4. Why would someone buy your product/service?

________

5. What kind of location do you need in terms of type of neighborhood, traffic count, nearby firms, etc.?

________

6. List your product/services suppliers.

________

7. List your major competitors - those who sell or provide like products/services.

________

8. List the labor and staff you require to provide your products/services.

________

Requirements For Success

To determine whether your idea meets the basic requirements for a successful new project, you must be able to answer at least one of the following questions with a "yes."

1. Does the product/service/business serve a presently unserved need?

2. Does the product/service/business serve an existing market in which demand exceeds supply?

3. Can the product/service/business successfully compete with an existing competition because of an "advantageous situation," such as better price, location, etc.?

Major Flaws

A "Yes" response to questions such as the following would indicate that the idea has little chance for success.

1. Are there any causes (i.e., restrictions, monopolies, shortages) that make any of the required factors of production unavailable (i.e., unreasonable cost, scare skills, energy, material, equipment, processes, technology, or personnel)?

2. Are capital requirements for entry or continuing operations excessive?

3. Is adequate financing hard to obtain?

4. Are there potential detrimental environmental effects?

5. Are there factors that prevent effective marketing?

Desired Income

The following questions should remind you that you must seek both a return on your investment in your own business as well as a reasonable salary for the time you spend in operating that business.

1. How much income do you desire?

2. Are you prepared to earn less income in the first 1-3 years?

3. What minimum income do you require?

4. What financial investment will be required for your business?

5. How much could you earn by investing this money?

6. How much could you earn by working for someone else?

7. Add the amounts in 5 and 6. If this income is greater that what you can realistically expect from your business, are you prepared to forego this additional income just to be your own boss with the only prospects of more substantial profit/income in future years?

8. What is the average return on investment for a business of your type?

Preliminary Income Statement

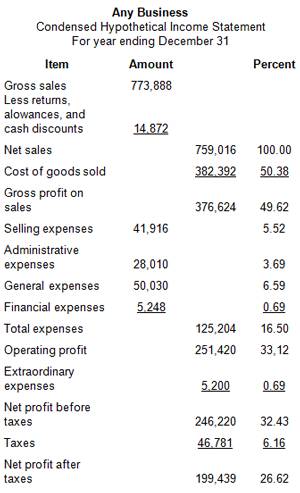

Besides return on investment, you need to know the income and expenses for your business. You show profit or loss and derive operating ratios on the income statement. Dollars are the (actual, estimated, or industry average) amounts for income and expense categories. Operating ratios are expressed as percentages of net sales and show relationships of expenses and net sales.

For instance 50,000 in net sales equals 100% of sales income (revenue). Net profit after taxes equals 3.14% of net sales. The hypothetical "X" industry average after tax net profit might be 5% in a given year for firms with 50,000 in net sales. First you estimate or forecast income (revenue) and expense dollars and ratios for your business. Then compare your estimated or actual performance with your industry average. Analyze differences to see why you are doing better or worse than the competition or why your venture does or doesn't look like it will float.

These basic financial statistics are generally available for most businesses from trade and industry associations, government agencies, universities and private companies and banks

Forecast your own income statement. Do not be influenced by industry figures. Your estimates must be as accurate as possible or else you will have a false impression.

1. What is the normal markup in this line of business. i.e., the dollar difference between the cost of goods sold and sales, expressed as a percentage of sales?

2. What is the average cost of goods sold percentage of sales?

3. What is the average inventory turnover, i.e., the number of times the average inventory is sold each year?

4. What is the average gross profit as a percentage of sales?

5. What are the average expenses as a percentage of sales?

6. What is the average net profit as a percent of sales?

7. Take the preceding figures and work backwards using a standard income statement format and determine the level of sales necessary to support your desired income level.

8. From an objective, practical standpoint, is this level of sales, expenses and profit attainable?

Market Analysis

The primary objective of a market analysis is to arrive at a realistic projection of sales. after answering the following questions you will be in a better positions to answer question eight immediately above.

Population

1. Define the geographical areas from which you can realistically expect to draw customers.

2. What is the population of these areas?

3. What do you know about the population growth trend in these areas?

4. What is the average family size?

5. What is the age distribution?

6. What is the per capita income?

7. What are the consumers' attitudes toward business like yours?

8. What do you know about consumer shopping and spending patterns relative to your type of business?

9. Is the price of your product/service especially important to your target market?

10. Can you appeal to the entire market?

11. If you appeal to only a market segment, is it large enough to be profitable?

Competition

1. Who are your major competitors?

2. What are the major strengths of each?

3. What are the major weaknesses of each?

4. Are you familiar with the following factors concerning your competitors:

Price structure?

Product lines (quality, breadth, width)?

Location?

Promotional activities?

Sources of supply?

Image from a consumer's viewpoint?

5. Do you know of any new competitors?

6. Do you know of any competitor's plans for expansion?

7. Have any firms of your type gone out of business lately?

8. If so, why?

9. Do you know the sales and market share of each competitor?

10. Do you know whether the sales and market share of each competitor are increasing, decreasing, or stable?

11. Do you know the profit levels of each competitor?

12. Are your competitors' profits increasing, decreasing, or stable?

13. Can you compete with your competition?

Sales

1. Determine the total sales volume in your market area.

2. How accurate do you think your forecast of total sales is?

3. Did you base your forecast on concrete data?

4. Is the estimated sales figure "normal" for your market area?

5. Is the sales per square foot for your competitors above the normal average?

6. Are there conditions, or trends, that could change your forecast of total sales?

7. Do you expect to carry items in inventory from season to season, or do you plan to mark down products occasionally to eliminate inventories? If you do not carry over inventory, have you adequately considered the effect of mark-down in your pricing? (Your gross profits margin may be too low.)

8. How do you plan to advertise and promote your product/service/business?

9. Forecast the share of the total market that you can realistically expect - as a dollar amount and as a percentage of your market.

10. Are you sure that you can create enough competitive advantages to achieve the market share in your forecast of the previous question?

11. Is your forecast of dollar sales greater than the sales amount needed to guarantee your desired or minimum income?

12. Have you been optimistic or pessimistic in your forecast of sales?

13. Do you need to hire an expert to refine the sales forecast?

14. Are you willing to hire an expert to refine the sales forecast?

Supply

1. Can you make a list of every item of inventory and operating supplies needed?

2. Do you know the quantity, quality, technical specifications, and price ranges desired?

3. Do you know the name and location of each potential source of supply?

4. Do you know the price ranges available for each product from each supplier?

5. Do you know about the delivery schedules for each supplier?

6. Do you know the sales terms of each supplier?

7. Do you know the credit terms of each supplier?

8. Do you know the financial condition of each supplier?

9. Is there a risk of shortage for any critical materials or merchandise?

10. Are you aware of which supplies have an advantage relative to transportation costs?

11. Will the price available allow you to achieve an adequate markup?

Expenses

1. Do you know what your expenses will be for: rent, wages, insurance, utilities, advertising, interest, etc?

2. Do you need to know which expenses are Direct, Indirect, or Fixed?

3. Do you know how much your overhead will be?

4. Do you know how much your selling expenses will be?

Miscellaneous

1. Are you aware of the major risks associated with your product? Service Business?

2. Can you minimize any of these major risks?

3. Are there major risks beyond your control?

4. Can these risks bankrupt you? (fatal flaws)

Venture Feasibility

1. Are there any major questions remaining about your proposed venture?

2. Do the above questions arise because of a lack of data?

3. Do the above questions arise because of a lack of management skills?

4. Do the above questions arise because of a "fatal flaw" in your idea?

5. Can you obtain the additional data needed?

7. Are you aware that there is less than a 50-50 chance that you will be in business two years from now?

3. Starting Your New Venture

Say that you are the type who can operate a business of your own. You have given attention to the overall chances for success, and have chosen the business you wish to establish. What practical problems will you face in starting the business? How much money will you need? Where can you obtain it? What form of business organization will you have? Where should you locate the business?

Cash Planning

The first question you want to answer is: How much money will I need? But this question can't be answered until several other questions are answered and several decisions are made.

To decide how much money is needed to start a business, enter all of your potential income and all of your planned expenses on a work sheet or form.

Even though you may feel that this kind of planning is more than you need to start a simple small business it is useful to get started with this approach to management which puts figures down in black and white. You will find the same approach valuable in an established business.

First, estimate your sales volume. This will depend on the total amount of business in the area, the number and ability of competitors now sharing that business, and your own capability to compete for the consumer's dollar. Obtain assistance in making your sales estimate from wholesalers, trade associations, your banker, and other business-people. Several business and statistical publications may be useful in making sales volume estimates.

In reaching your final estimate of sales do not be over-enthusiastic. A new business generally grows slowly at the start. If you overestimate sales you are likely to invest too much in equipment and initial inventory, and commit yourself to heavier operating expenses than your actual sales volume will justify. Since you are just starting up you might have no sales for the first few months. At any rate you can expect your first few months to be very low.

You must also determine what proportion of your sales will be cash and what proportion will be sold on credit. If you estimate that a certain portion of the sales will be on credit then you must figure when you are going to get the money for these sales. One month? Two months? More? Never?

Next, estimate how much cash will be paid out. Remember that in starting a business you may be purchasing equipment, paying fees and licenses, making deposits on lease, utilities and so on, several months before you open the door. Some of these expenses are easy to estimate. If you have decided to lease a building (more about that later) then you know what your deposits will be and how much you will have to pay out each month. You can probably get the cost of fees, licenses and utility deposits with a few telephone calls.

Other expense figures may take a little more work to get. One way is to obtain typical operating ratios for the kind of business in which you are interested. Among the sources for such ratios are Dun & Bradstreet, Inc., trade associations, publishers of trade magazines, specialized accounting firms, industrial companies, and colleges and universities. The typical ratios for your type of business multiplied by your estimated sales volume will serve as bench marks for estimating the various items of expense. However, do not rely exclusively on this method for estimating each expense item. Verify and modify these estimates through investigation and quotations in the particular market area where you plan to operate.

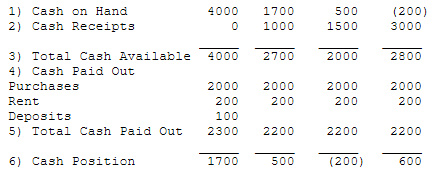

Don't forget to pay yourself too. You may need money to live on if you have to quit your job. If your spouse is working and can support the family for a while you may not have to withdraw money from the business. The longer you can go without taking money out, the quicker you will build up a strong cash position. Now that you have estimated your cash receipts and expenses, write down the amount of cash you will put into the business to start. This goes on line 1 in the example below. Next, add lines 1 and 2 for the first month to get line 3. Then add up all of the expenses to get line 5. Subtract line 5 from line 3 to get line 6. This cash at the end of month 1 then goes to line 1 for the beginning of the next month, and so on.

If you continue this for the entire year, very soon you will find you have negative numbers or a negative cash flow. About this time you will also realize that you should be working on this form with a pencil that has a good eraser.

Let's see what a simple forecast for a few months might look like:

In this overly-simplified illustration, you see that by the end of June you are minus $200 in cash. Two solutions can be tried - reduce your purchases in June by $200 or start with $200 more. You may not be able to reduce expenses (they will probably go up as your business starts). So you will have to put in $200 more to start with. If all you have is $4000 then the additional $200 you need is capital you must get from somewhere else.

Don't be misled by this simple illustration. Many small businesses start with the $200, and try to get the $4000 from someplace else. Since a major reason for failure in the early stages of a business is under-capitalization, be very careful in your planning at this stage. You can almost always plan on some unexpected expenses and some delays in expected income.

Getting the Money

Now that you have computed your initial capital requirements, where will you get the money? The first source is your personal savings. Then relatives, friends, or other individuals may be found who are willing to "venture" their savings in your business. Before obtaining too large a share of money from outside sources, remember you should have personal control of enough to assure yourself ownership.

Once you can show that you have carefully worked out your financial requirements and can demonstrate experience and integrity, a lending institution may be willing to finance part of your operating needs. This may be done on a short term basis of from 60 days to as much as one year. Any institution that has money to lend is primarily concerned with security. The security may be a business asset, but when you're just starting the best security is usually your home or some other personal asset.

The second thing the lender will want to see is some sort of business plan. If you complete a business plan - which includes a cash flow forecast - the lender will see that you have done some serious and realistic thinking about your business and be more likely to consider your request.

Become acquainted with your banker. In selecting a banker consider progressiveness, attitude toward your business, credit services offered, and the size and management policies of the bank. Is the bank progressive? The physical appearance of the bank may give you some indication. When the employees are reasonably young, interested in your problems and active in civic affairs the bank is likely to be progressive. The character of the bank's advertising may also be a clue to its progressiveness.

To be effective the banker should be interested in helping you to become a better manager, and build a continuing relationship that will mean profitable business for you and the bank over the years.

Will the bank offer you the kind of credit you need? For example, if seasonal accumulations of inventory become a problem will the bank make a loan against public or field warehouse receipts? If your capital is tied up in accounts receivable during your heavy selling season, will the bank take these receivables as security for a loan? Will the bank consider a term loan?

Finally, know the size and management policies of the bank. Will your maximum requirements fall well within the bank's "legal limit"? If you plan to do some export business, does it have a foreign exchange department? If you or your dealers sell on installment terms does the bank have facilities for handling installment paper? How deeply is the bank concerned with the growth and prosperity of your local community?

When you deal with your banker, sell yourself. Whether or not you need a bank loan, make it a practice to visit your banker at least once a year. Openly discuss your plans and difficulties. It is the bank's business not to betray a confidence. If you need financial assistance carefully prepare, in written form, complete information that will present a thorough understanding of your entire proposition. Many business-people or prospective business operators destroy their chances of obtaining financial help by failing to present their proposition properly. Remember, before a banker will make a loan he/she must have satisfactory answers to questions such as these:

1. What sort of person are you?

2. What will you do with the money?

3. When and how do you plan to pay it back?

4. Does the amount requested allow for unexpected developments?

5. What is the outlook for you, for your line of business, and for business in general?

Trade creditor or equipment manufacturer, Companies from which you buy equipment or merchandise may also furnish capital to you in the form of extended credit. Manufacturers of store fixtures, cash registers, and industrial machinery frequently have financing plans under which you may buy on an installment basis and pay out of future income. You need not pay for the goods at once. If goods are for resale, no security other than repossession rights of the unsold goods is involved. However, too extended a use of credit may prove expensive. Usually cash discounts are quoted if a bill is paid within 10, 30, or 60 days. For example, a term of sale quoted as "2-10; net 30 days" means that a cash discount of 2 percent will be granted if the bill is paid within 10 days. If not paid in 10 days, the entire amount is due in 30 days. If you do not take advantage of the cash discount, you are paying 2 percent to use money for 20 days, or 36 percent per year. This is high interest. Avoid it.

One of the principal causes of failures among businesses is inadequate financing. If you do go into business, remember it is your responsibility to provide, or obtain from others, sufficient money to supply a firm foundation for your enterprise.

Sharing Ownership With Others

Now that you have decided what business to start and about how much capital will be required, you may find it necessary to join with one or more associates to launch the enterprise.

Partnership

If you lack certain technical or management skills which are of major importance to your chosen business a partner with these skills may prove a most satisfactory way to cover the deficiency. If you are very skilled in your special area but lack management training and skills, you might look for a partner with a background in management. If you may need more start-up money, sharing the ownership of the business is one way to obtain it. Great care should be taken in deciding upon a partner. Personality and character, as well as ability to render technical or financial assistance, affect the success of a partnership.

A partnership can be a mixed blessing. A partner who puts in time or money has a right to expect a share in running the business.

In a partnership the liability for the debts of the firm is unlimited, just as it is in a single proprietorship. This means the owners are personally responsible for the firm's debts, even in excess of the amount they have invested in the business. In a corporation the liability of the owner is limited to the amount they pay for their shares of stock. A partnership, like a single proprietorship, lacks continuity. This means the business terminates upon the death of the owner or a partner, or upon the withdrawal of a partner.

Corporation

The corporation is a legal entity whose continuity is unaffected by death or transfer of stock shares by any or all of its owners. Even with no partners, you may decide a corporation with minor stockholders is better than a single proprietorship primarily because of the corporation's limited liability.

Since partnership agreements and incorporation papers should be prepared by a lawyer, consultation with a lawyer will help you determine the best type of organization for you.

Selecting a Location

Once you have decided what type of business you want to start and the investment requirements, you are ready to select a location. The number of competitive businesses already in the area should influence your choice of location. Some areas are overloaded with service stations or certain types of restaurants. Check on the number of your kind of business in Census figures, the yellow pages, or by personally checking out the location.

Factors other than the potential market, availability of employees and number of competitive businesses must be considered in selecting a location. For instance, how adequate are utilities - sewer, water, power, gas? Parking facilities? Police and fire protection? What about housing and environmental factors such as schools, cultural and community activities for employees? What is the average cost of the location in taxes and rents? Check on zoning regulations. Evaluate the enterprise of the local business-people, the aggressiveness of civic organizations. In short, what is the town spirit? Such factors should give you a clue to the city or town's future.

Chambers of Commerce and nearby universities usually have made or are familiar with local surveys which can provide answers to these questions and the many other questions which will occur to you.

Next you must decide in what part of town to locate. If the town is very small and you are establishing a retail or service business, there will probably be little choice. Only one shopping area exists. Cities have outlying shopping centers in addition to the central shopping area, and stores spring up along principal thoroughfares and neighborhood streets.

Consider the shopping center. It is different from other locations. The shopping center building is pre-planned as a merchandising unit. The site has been deliberately selected by a developer. On-site parking is a common feature. Customers may drive in, park and do their shopping in relative safety and speed. Some centers provide weather protection. Such conveniences make the shopping center an advantageous location.

There are also some limitations you should know about. As a tenant, you become part of a merchant team and must pay your pro rata share of the budget. You must keep store hours, light your windows, and place your signs according to established rules. Many communities have restrictions on signs and the center management may have further limitations. Moreover, if you are considering a shopping center for your first store you may have an additional problem. Developers and owners of shopping centers look for successful retailers.

The kind and variety of merchandise you carry helps determine the type of shopping area you choose. For example, clothing stores, jewelry stores and department stores are more likely to be

successful in shopping districts. On the other hand, grocery stores, drug stores, filling stations, and bakeries usually do better on principal thoroughfares and neighborhood streets outside the shopping districts. Some kinds of stores customarily pay a low rent per square foot, while others pay a high rent. In the "low" category are furniture, grocery and hardware stores. In the "high" are cigar, drug, women's furnishings, and department stores. There is no hard and fast rule, but it is helpful to observe in what type of area a store like yours most often appears to flourish.

After determining an area best suited to your type of business, obtain as many facts as you can about it. Check the competition. How many similar businesses are located nearby? What does their sales volume appear to be? If you are establishing a store or service trade, how far do people come to trade in the area? Are the traffic patterns favorable? If most of your customers will be local inhabitants, study the population trends of the area. Is population increasing, stationary or declining? Are the people native-born, mixed or chiefly foreign? Are new ethnic groups coming in? Are they predominantly laborers, clerks, executives or retired persons? Are they all ages or principally retired, middle aged, or young? Judge buying power by checking average home rental, average real estate taxes, number of telephones, number of automobiles and, if the figure is available, per capita income. Larger shopping centers have this type of information available, and will make it available to serious potential tenants.

Zoning ordinances, parking availability, transportation facilities and natural barriers - such as hills and bridges - are all important considerations in locating any kinds of business. Possible sources for this information are Chambers of Commerce, trade associations, real estate companies, local newspapers, banks, city officials, local merchants and personal observation. If the Bureau of the Census has developed census tract information for the particular area in which you are interested you will find this especially helpful. A census tract is a small, permanently established, geographical area within a large city and its environs. The Census Bureau provides population and housing characteristics for each tract. This information can be valuable in measuring your market or service potential.

Choosing the actual site within an area may well be taking what you can get. Not too many buildings or plants will be suitable and at the same time, available. If you do have a choice, be sure to weigh the possibilities carefully.

For a manufacturing plant, consider the condition and suitability of the building, transportation, parking facilities, and the type of lease. For a store or service establishment, check on the nearest competition, traffic flow, parking facilities, street location, physical aspects of the building, type of lease and cost, and the speed, cost and quality of transportation. Also investigate the history of the site. Find answers to such questions as: Has the building remained vacant for any length of time? Why? Have various types of stores occupied it for short periods? It may have proved unprofitable for them. Sites on which many enterprises have failed should be avoided. Vacant buildings don't bring traffic and are generally regarded as bad neighbors, so check on nearby unoccupied buildings.

Use a Score Sheet

To help choose your location use some type of "score sheet" in evaluating different sites. See the following suggested score sheet. Depending upon your kind of business and situation some factors will have more importance than others. You may wish to eliminate some factors listed in the sample and add others. But some sort of score sheet is essential to choosing your business location wisely.

Time and effort devoted to the selection of (a) the town or city, (b) the area within the town or city, and (c) the particular site for the location of your business can well mean the difference between success and failure.

Score Sheet on Sites

Grade each factor: "A" for excellent, "B" for good, "C" for fair, and "D" for poor.

1. Centrally located to reach my market

2. Physical suitability of building

3. Type and cost of lease

4. Provision for future expansion

5. Overall estimate of quality of site in 10 years

6. Adequacy of utilities (sewer, water, power, gas)

7. Parking facilities

8. Transportation availability and rates

9. Nearby competition situation

10. Traffic flow

11. Taxation burden

12. Quality of police and fire protection

13. Environmental factors (schools, cultural, community activities, enterprise of business people

14. Quantity of available employees

15. Prevailing rates of employee pay

16. Housing availability for employees

17. Merchandise or raw materials readily available

4. Buying a Going Business

Sometimes the best way to become the owner of a business is to buy a going concern. If you are considering this option, most of the factors already discussed should be considered plus these additional points.

Advantages

Certain advantages may be gained by purchasing a going business.

You may be able to buy the business at a bargain price, if, for personal reasons, an owner is sufficiently eager to sell.

Buying a business as it stands will save time and effort in equipping and stocking it.

You gain customers accustomed to trading with the establishment.

Key personnel with customer following may be willing to stay.

The "good will' created by the previous owner may be a valuable asset.

Disadvantages

You may pay too much for the business because of your inaccurate appraisal or the former owner's misrepresentation.

If the owner had a bad reputation you would inherit prejudices of former customers and, perhaps, of merchandise and equipment suppliers.

The location may be going sour.

Fixtures and equipment may be outmoded or in bad condition. Check carefully.

Too much of the merchandise or materials on hand may be old or poorly selected.

In deciding how much to pay for a going business, consider its profit potential. Tangible assets such as equipment and inventory may be important to you, but only to the extent that they contribute to future profits. If the seller is asking a large sum for the intangible asset of good will, estimate carefully how much - if anything - it will add to your future profits. Also, determine and assess precisely the cost of any liabilities you will be expected to assume. Get it in writing!

Profit Potential

You must be concerned with the future profitability of the business. Most businesses have a natural cycle. Retail stores usually have a cycle of one year. That is, each year follows the same pattern and several years indicate a trend. Certain types of heavy manufacturing companies may have up to a 7-year cycle. Try to estimate several (at least three) cycles. Thus, in some businesses you will be estimating three to five years while in another you may be estimating future sales and profits over a 25-year period. Obviously your estimate for the next two years will be more precise than your estimate for 25 years in the future. This doesn't mean you should be careless in your long range planning. It does mean your long range estimates will be more general and subject to change.

To estimate future profits, begin by analyzing the present owner's balance sheets and profit and loss statements for at least 5 years back. Going back 10 years would be even better. Many businesses have inadequate or no records, but all should have copies of their income tax returns. Sometimes even these are lacking or, more likely, very suspicious. Some businesses have been known to prepare inaccurate tax returns. Insist on seeing accurate records. If you are serious about purchasing a particular business, consider making a deposit subject to receiving accurate business records.

You want to look at many factors and ratios from this financial data. What has been the rate of return on investment? Does it compare favorably with the rate you can obtain from other investment opportunities? How does it compare with averages for other businesses of the same kind? Have sales over the years been increasing or decreasing?

What share of the market is the business obtaining within its market area? To find out requires an analysis of the local market for the particular firm in which you are interested. What is the competition in the area, the population, the purchasing power? What are the trends? What is the outlook for increasing sales?

Are the profits satisfactory? If not, what are the chances of increasing them? Have profits been consistent over a period of years? If the last year's profit was unusually high in comparison with previous years, why was it? What is the profit trend? Have profits been increasing consistently? Have they leveled off? Started to decrease? What are the reasons for the profit trend, whatever it may be? Be sure such questions are answered to your satisfaction before you buy.

Study the expense ratios. How does the percentage for each expense classification compare with the average for the trade? The availability of average operating ratios for certain trades has already been mentioned. Comparison of the figures of the business offered for sale with standard ratios will bring out any discrepancies. In discussing these discrepancies with the seller you may become aware of operating problems which will help in making up your mind how much to pay for the business, or whether to buy it at all.

You need not necessarily be discouraged from buying the business if past profit records are not favorable. Very often the reason the business is for sale is because of recent poor earnings. Examination may reveal that these have been brought about by poor management; and you may be convinced that your management will improve the situation. By the same token, an excellent past earnings' record, in itself, should not persuade you to pay a large amount for the business without further investigation.

Ask the seller to prepare a projected statement of profit and loss for the next 12 months. Such an estimate will probably be very optimistic and should be compared with your own estimate. With a detailed estimate of the next 12 months' operation, you can compute working-capital requirements for each month. Next, estimate the value of assets and liabilities as of the end of that period. Find the estimated return on investment by dividing the projected net profit by the price asked for the business. If you believe additional investment will be needed immediately to make the business run profitably, add this to the price in your computations. The highest price for the firm which brings you a return with which you are satisfied is the maximum price you should pay for the business. Thus, an estimate of future profitability will give you the basis of a logical offer for the business.

If you are not familiar with accounting and income tax records so that you may verify records of past operations and make a reasonable forecast of future operations, have an experienced accountant or management consultant work with you to help you understand the records and assist you in your evaluation.

Tangible Assets

The most commonly purchased tangible assets are merchandise inventory, equipment and fixtures, and supplies. If the business you plan to purchase sells on credit you probably will take over accounts receivable.

What is the condition of the inventory you are purchasing? Is the stock current, clean, well-balanced, in good condition? How much of it will have to be disposed of at a loss or given away? Make a careful appraisal of the stock. Each item should be separately priced and given a reasonable value. If at all possible, the inventory should be "aged"; that is, the length of time each group of items has been in stock over 18 months old,1 year to 18 months, 6 months to 1 year, and less than 6 months should be calculated. Usually, the older the inventory, the less its value.

Examine equipment and fixtures carefully. Remember you are buying second-hand furnishings with only a percentage of their original value. Be sure equipment is in working order. Find out its age. Obtain evaluations of similar equipment, new or second hand, from dealers. Not only should you know how much equipment and fixtures have depreciated, but how obsolete they may be. Office equipment may be in working order, but so obsolete that to use it would be inefficient and costly. Also, it may be difficult to obtain repair parts for old equipment in case of a breakdown. Store fixtures quickly become out of date. New, modern fixtures attract customers. Machines used in factories may have been superseded by far more efficient equipment. To pay an exorbitant price for old machinery, no matter how good its condition, is most unwise.

Make certain how much of the asking price is for furniture, fixtures and equipment. The business may not warrant the investment which the owner made. And, finally, find out if there is a mortgage on any of the fixtures or equipment, or if they even have been completely paid for.

If you are taking over the assets such as accounts receivable, credit records, sales records, mailing lists, or leases, investigate them closely. Accounts receivable should be aged to determine how many of them may be so old collection will be difficult or impossible. On the other hand, records and contracts involving favorable leases have real value. Make certain these are included in the sale.

Goodwill

Over and above the total appraisal of inventories, fixtures, equipment, and other assets, there will usually be an amount asked for goodwill. Do not confuse it with "net worth", which is the difference between the dollar values of the assets and liabilities of the business. Rather it is the ability of the business to realize a higher rate of return on the investment than ordinarily in the particular type of business because of the favorable public attitude created by the owner. When goodwill exists, it is a valuable asset. Be realistic in determining how much you should pay for goodwill.

No fixed formula can substitute for good judgment. Since you are paying for favorable public attitude, make an effort to check it. Question customers, bankers and others whom you feel have unbiased opinions. Who will have the goodwill after the business changes hands? Does it go with the business, or is it personally attached to and will it remain with the seller?

Consider also that there may be "ill will" attached to a business. customers may be unhappy with the business. You will have to overcome these ill feelings to become successful.

The term "goodwill" is in some ways an accountant's fiction designed to explain the difference between the real price and the net worth. Accountants usually favor writing off this "goodwill" in a short period of time. A test of the amount asked is to compare it with past profits of the business. How many months or years will it take before the "goodwill" can be paid for out of profits? During that period you will, in effect, be working for the seller rather than for yourself. Another way to judge the value of this intangible asset is to estimate how much more income you will receive by buying the going business than by starting a new one.

Or compare the price asked for goodwill with that asked for goodwill in similar businesses. In other words, if you are shopping around for a business, compare not only the total prices asked, but the amounts asked over and above the reasonable value of the net tangible assets.

Liabilities

Be sure the seller pays off accumulated debts before you pay the money agreed upon in the terms of the sale, so the business is 'clear'. Find out if there are mortgages, back taxes, liens upon the assets, or other creditors' claims. Obtain full information about any undelivered purchases for which you will be liable. Although it is generally not desirable to assume any liabilities, it may be necessary in some instances. If liabilities are assumed, be sure their value is subtracted from the agreed-upon value of the assets.

The Price

After you have determined what you believe to be net value you will still not have reached the final price to be paid for the business. Value relates to what the business is worth. Other factors which affect the final price must be considered. Only then can you begin to determine the final price through negotiation and bargaining.

What has the seller's reputation been among employees and suppliers? Poor relationships may require extra effort on your part to establish a smoothly running organization. Make sure suppliers will deal with you. If a franchise is involved, obtain satisfactory insurance from the supplier that it will not be withdrawn.

Why does the owner wish to sell? This should be one of your first questions. Is the reason given -a death in the family, poor health, or a needed change in climate - the really decisive factor? Or does the seller know the neighborhood is changing so his specific type of business will no longer be needed; or that a new civic development, or zoning law, will affect the business unfavorably? Search for his true reasons for selling by questioning not only him but others whom you know to be reliable.

Some business owners have sold out only to start a new business in competition with the buyer. Careful consideration should be given to placing limitations upon the seller's right to compete with you for a specific period of time and within a specified area.

As a safeguard against costly errors, obtain legal advice before any agreement is made. The agreement should be drawn up by a lawyer to ensure that it covers all essential points and is clearly understood by both parties. Among the items covered in a typical contract for the sale of a small business are:

A description of what is being sold.

The purchase price.

The method of payment.

A statement of how adjustments are to be handled at the time of closing (for example, adjustments for inventory sold, rent, payroll and insurance premiums).

Buyer's assumption of contracts and liabilities.

Seller's warranties (for example, warranty protection for the buyer against false statements of the seller, inaccurate financial data, undisclosed liabilities).

Seller's obligation and assumption of risk pending closing.

Covenant of seller not to compete.

Time, place and procedures of closing.

As soon as possible after signing the contract, take possession. Otherwise, the seller may deplete the inventory and, in some cases, create ill will for you.

5. Choosing a Franchise

Many small business owners have been helped to a sound start by investing in a franchise. You may wish to consider doing the same. Franchising can minimize your risk. It will enable you to start your business under a name and trade-mark which already have public acceptance. You will receive training and management assistance from people experienced in your line of business. Sometimes, you can also obtain financial assistance that will permit you to start with less cash than you would otherwise need.

On the other side of the coin are the sacrifices required when entering a franchised operation. You will lose a certain amount of control of your business. You will no longer truly be your own boss. And, of course, you must either pay a fee or share profits with the franchisor.

What Franchising Is

Essentially, franchising is a plan of distribution under which an individually-owned business is operated as part of a large chain. Services or products are standardized. It is a system used by a company (the franchisor) which gives the individual dealer (you, the franchisee) the right to market the franchisor's product or service by using the franchisor's trade name, trade marks, reputation, and way of doing business. The franchise agreement (or contract) usually also gives the franchisee the exclusive right to sell or otherwise represent the franchisor in a specified area. In return, the franchisee agrees to pay either a sum of money - a franchise fee, a percentage of gross sales or both, and frequently to buy equipment or supplies from the franchisor - or some combination of these considerations.

A reputable franchise may be the best successful business insurance inexperienced entrepreneurs can acquire.

Advantages of Franchising

Among the advantages of franchising to you as a franchisee are that you can start a business with:

1. Limited experience. You can use the franchisor's experience which you might otherwise have to obtain the hard way - through trial and error.

2. A relatively small amount of capital and a strengthened financial and credit standing. Some franchisors give financial assistance so you can start with less than the usual amount of cash. For example the franchisor may accept a down payment with your note for the balance of the needed initial capital. Or, the franchisor may allow you to delay your payments for royalties, purchases, or other fees to help you over the initial rough spots. With a well known, successful franchisor behind you, your standing with local financial institutions and credit associations is strengthened.

3. A well developed consumer image and goodwill with proven products and services. Because the goods and services of the franchisor are well-known, your business has "instant" pulling power. To develop equivalent pulling power on your own might take years of promotion and considerable investment.

4. Competently designed facilities, layout, displays and fixtures. The franchising company has effectively designed facilities, layout, displays and fixtures prepared by experts and proven by nationwide usage.

5. Chain buying power. You should receive savings through the franchisor's quantity purchasing of products, equipment, supplies, advertising materials and other business needs.

6. Business training and continued management assistance from experienced company personnel. You can expect advance training in the mechanics of your particular business. Some franchisors will guide you in day-to-day operations until you are proficient. Moreover, management consulting service is provided by many franchisors on a continuing basis. This usually includes help with record keeping and other essential activities.

7. National or regional promotion and publicity. National and/or regional promotions of the franchisor will help your business. You will receive help with local advertising. The franchisor's research and development program will assist you in keeping up with competition and changing times. Best of all, the immediate identification many franchise operations enjoy will bring pre-sold customers to your door.

All of these factors can help increase your income and lower your chances of failure.

Disadvantages of Franchising

Now, what are the disadvantages of franchising? Some of them are the:

1. Required standardized operations. You cannot make all of the rules. Contrary to the "be your own boss" lures in franchise advertisements, you will not be your own boss. You must subjugate your personal identity to that of the franchisor. If an important satisfaction to you is to have your business known by your name, a franchise operation is not for you. Most franchisors have the right to exert control and pressure you (1) to conform to standardized procedure; (2) to handle specific products or services which may not be particularly suitable or profitable in your marketing area; and (3) to follow other policies which may benefit others in the chain but not always you. You lose the freedom to make most decisions. In other words, you are not your own boss.

2. Sharing profits with the franchisor. The franchisor nearly always charges a royalty on a percentage of gross sales. The royalty fee must ultimately come out of your profits. Sometimes it must be paid whether you make a profit or not, and it must often be paid before the operation is established. On the other hand, the franchisor does not usually share your losses.

3. Lock of freedom to meet local competition. Under a franchise you may be restricted in establishing selling prices, in introducing additional products or service or dropping unprofitable ones, regardless of the local competition you must meet.

4. Danger of contracts being slanted to the advantage of the franchisor. Clauses in some contracts, imposed by the franchisor, may provide for unreasonably high sales quotas, mandatory working hours, cancellation or termination of the franchise for minor infringements, and/or restrictions on the franchisee in transferring his franchise or recovering his investment. The territory assigned the franchisee may be overlapping with that of another franchisor or may be otherwise inequitable. In settling disputes of any kind the bargaining power of the franchisor may be greater than that of the franchisee. In the past, fast food franchisees worked a median of 60 hours a week; some families as much as 120 hours. As the owner, you may still opt to do this. Alleged infringement of the franchisee's exclusive territory, long a major source of friction between franchisee and franchisor, need not be if your attorney oversees the contract. The power imbalance in favor of the franchisor is usually due not only to the franchisee's smaller financial resources but to a lack of information - information which the franchisor usually has.

5. Time spent preparing reports for the franchisor. Franchisors require specific reports and you may consider the time and effort in preparing them inordinately burdensome. On the other hand if these reports are helpful to the franchisor it is likely that they will also help you to manage your business more effectively.

6. Sharing the burden of the franchisor's mismanagement. While ordinarily the franchisor's chain develops good will among consumers, there may be instances in which ill will is developed by one of the units. As one link in the chain, you may suffer despite the excellence of your particular unit. Fortunately, in recent years this has been an infrequent occurrence.

7. Few management decisions. As a franchisee, you will probably not be permitted to make management decisions even to meet changing conditions in your territory. Canceling a product or introducing a new one is seldom allowed - certainly not without consultation with a representative of the franchisor and, possible, contract revision. The same applies to a desire to expand your operation beyond its specified geographic limits. As an entrepreneurial type, constant submission to the letter of the contract may become an irritant. On the other hand, the safeguard of the franchisor's name and mode of doing business - if it results in profits - may make the restrictions more palatable. Also, some of the larger franchisors now hold annual meetings with their franchisees and encourage open discussion and initiative.

Checklist for Evaluating a Franchise

The Franchise

Did your lawyer approve the franchise contract you are considering after he studied it paragraph by paragraph?

Does the franchise call upon you to take any steps which are, according to your lawyer, unwise or illegal in your county or city? What are they?

Does the franchise give you an exclusive territory for the length of the franchise, or can the franchisor sell a second or third franchise in your territory?

Is the franchisor connected in any way with any other franchise company handling similar merchandise or services?

If the answer to the last question is "yes", what is your protection against this second franchisor organization?

Under what circumstances can you terminate the franchise contract and at what cost to you, if you decide for any reason at all that you wish to cancel it?

If you sell your franchise, will you be compensated for your good will, or will you lose the good will you have built into the business?

The Franchisor

How many years has the firm offering you a franchise been in operation?

Has it a reputation for honesty and fair dealing among the local firms holding its franchise?

Has the franchisor shown you certified figures indicating exact net profits of one or more going firms which you personally checked with the franchisee(s)?

Will the firm assist you with:

A management training program?

A public relations program?

Credit?

An employee training program?

Capital?

Merchandising ideas?

Will the firm help you find a good location to carry out its stated plan of financial assistance and expansion?

Is the franchising firm adequately financed to carry out its stated plan of financial assistance and expansion?

Is the franchisor a one-man company or a corporation with experienced management in such depth that there will always be an experienced person at its head?

Exactly what can the franchisor do for you which you cannot do for yourself?

Has the franchisor investigated you carefully and successfully enough to be assured that you can operate one of their franchises at a profit both to them and to yourself?

Has the franchisor complied with the law regulating the sale of franchises?

How much equity capital must you have to purchase the franchise and operate it until your income equals your expenses? Where will you get it?

Are you prepared to give up some independence of action to secure the advantages offered by the franchise?

Do you really believe you have the innate ability, training and experience to work smoothly and profitably with the franchisor? Your employees? Your customers?

Are you ready to spend much or all of the remainder of your business life with this franchise company, offering its product or service to your public?

Your Market

Have you made any study to determine whether the product or service which you propose to sell under franchise has a market in your territory at the prices you will have to charge?

Will the consumer population in the territory given you increase? Remain static? Decrease over the next 5 years?

Five years from now, will the product or services you are considering be in greater demand? About the same? Or in less demand?

What competition for the product or service you contemplate selling already exists in your territory? Non-franchise firms? Franchise firms?

6. Ten Essential Aspects of Managing a Business

This book offers guidance in starting a business. But you are not ready to start your own business until you have given some thought to managing it. A business is an ongoing activity that doesn't run itself. As the manager you will have to set goals, determine how to reach those goals and make all the necessary decisions. You will have to purchase or make your product, price it, advertise it and sell it. You will have to keep records, and determine costs. You will have to control inventory, make the right buying decisions and keep costs down. You will have to hire, train and motivate employees now or as you grow.

Setting Goals

Good management is the key to success and good management starts with setting goals. Set goals for yourself for the accomplishment of the many tasks necessary in starting and managing your business successfully. Be specific. Write down the goals in measurable terms of performance. Break major goals down into sub-goals, showing what you expect to achieve in the next two to three months, the next six months, the next year, and the next five years. Beside each goal and sub-goal place a specific date showing when it is to be achieved.

Plan the action you must take to attain the goals. While the effort required to reach each sub-goal should be great enough to challenge you, it should not be so great or unreasonable as to discourage you. Do not plan to reach too many goals all at one time. Establish priorities.

Plan in advance how to measure results so you can know exactly how well you are doing. This is what is meant by "measurable" goals. If you can’t keep score as you go along you are likely to lose motivation. Re-work your plan of action to allow for obstacles which may stand in your way. Try to foresee obstacles and plan ways to avert or minimize them.

Buying

Skillful buying is an important essential of profitable operation. This is true whether you are a wholesaler or retailer of merchandise, a manufacturer or a service business operator. Some retailers say it is the most important single factor. Merchandise which is carefully purchased is easy to sell.

Determining what to buy means finding out the type, kind, quality, brand, size, color, style -whatever applies to your particular inventory - which will sell the best. This requires close attention to salespeople, trade journals, catalogs, and especially the likes and dislikes of your regular customers. Analyze your sales records. Even the manufacturer should view the problem through the eyes of customers before deciding what materials, parts, and supplies to purchase.

Know your regular customers, and make a good evaluation of the people you hope will become your customers. In what socioeconomic category are they? Are they homeowners or renters? Are they looking for price, style or quality? What is the predominant age category?

The age of your customers can be a prime consideration in establishing a purchasing pattern. Young people buy more frequently than most older people. They need more, have fewer responsibilities, and spend more on themselves. They are more conscious of style trends whether in wearing apparel, cars or electronic equipment. If you decide to cater to the young trade because they seem dominate in your area, your buying pattern will be completely different than if the more conservative middle-aged customers appear to be in the majority.